Issue 6: All Time Highs

Summer 2025

INTRODUCTION

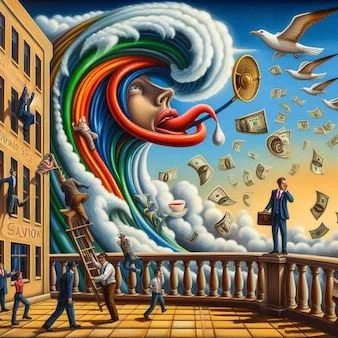

During the recent months, our favorite US equity index the SP500 made a round trip plunging over 15% and climbed back to an all time high. Trillions (in valuation) were lost and recovered in just a few months. Those who panicked at the bottom missed out on the recovery. Those who seized the fire sale made out like bandits. Yet had you been stranded on an island from Valentine’s Day until Independence Day, you would not have noticed much in your portfolio other than a steady climb.

DON’T PANIC

During the biggest drops, we were often asked:

“What do you think about the markets?”

“Did you lose a lot?”

“Are you going to get out?”

Being long term investors and having weathered our generation’s economic cycles, we try to remind people in a dip that they own just as many shares as they did before the dip. Also, they will own just as many shares when the market recovers…and history has only ever shown us that there will always be another ALL TIME HIGH.

TIME MATTERS

Of course, we recognize that the actual question is “When will the markets recover?” Some were building a down payment for their first home using stocks. Dips are a reminder that volatility can foil your plans, and they aren’t always short lived. John Maynard Keynes once said "Markets can remain irrational longer than you can remain solvent.”

For those no longer earning income (retired), a market recovery might not come around before the money is needed. It’s one of the reasons that investors tend to pull back on equities as they advance in age. A common guideline is to subtract your age from 100 to determine the percentage of your portfolio that should be allocated to stocks. At age 75, this old adage suggests having 25% in equities and 75% in fixed income.

Finally, aren’t we supposed to “buy low, and sell high?” This saying sounds obvious, but it’s psychologically very difficult in practice. Very few people were asking about where to invest when the markets were tanking. They were overwhelmed by fear when they should have instead smelled opportunity. Now that the markets have recovered, not enough people are interested in selling!

GUT CHECK

Valuations are a multiple of earnings. Since earnings of the top companies have risen over time, the values of such companies have naturally risen over time as well. Checking the multiple, in other words the price to earnings or PE ratio, is a common way to see if valuations seem reasonable. As of this writing, the Shiller PE Ratio for the SP500 is currently at ~38. We’ve been here only 2 other times in history. During the 90s Internet Bubble and during COVID.

Check your asset allocation. Calculating for age, is it time to rebalance the portfolio? Would it make sense to sell some equities in exchange for a greater proportion of fixed income (bonds, money market, high yield savings)? Equities at all time highs could be the ideal time to reposition the portfolio…not when the market is tanking.

Sell? If you have significant purchases or other investments to pursue, this might not be a bad time to trade in some equities. “Sell High!” You’d be giving up the fewest number of shares to do so.

SUMMARY

The markets just lost and recovered trillions in valuation over several months. During that period, investors who did nothing owned the exact number of shares between Valentine’s Day and Independence Day. We are once again at an all time high in valuation for the SP500. This could be the ideal time to rebalance your portfolio and prepare for the next dip. If you were holding off on a big purchase, maybe this is the time to “Sell High!”

Jon & Anh @MyUncle_Satoshi

All statements are a collection of our thoughts and not financial advice.